Profile For RobMac

RobMac's Info

-

Location:

Tampa Bay, FL -

Driving Status:

Considering A Career -

Social Link:

RobMac On The Web -

Joined Us:

6 years, 11 months ago

RobMac's Bio

Musician, concert sound mixer, former paramedic, and dabbled in IT a bit. Considering trucking as a new profession.

Comments By RobMac

Page 1 of 1

Posted: 6 years, 11 months ago

View Topic:

New per diem laws and affect on lease vs compny

This might help

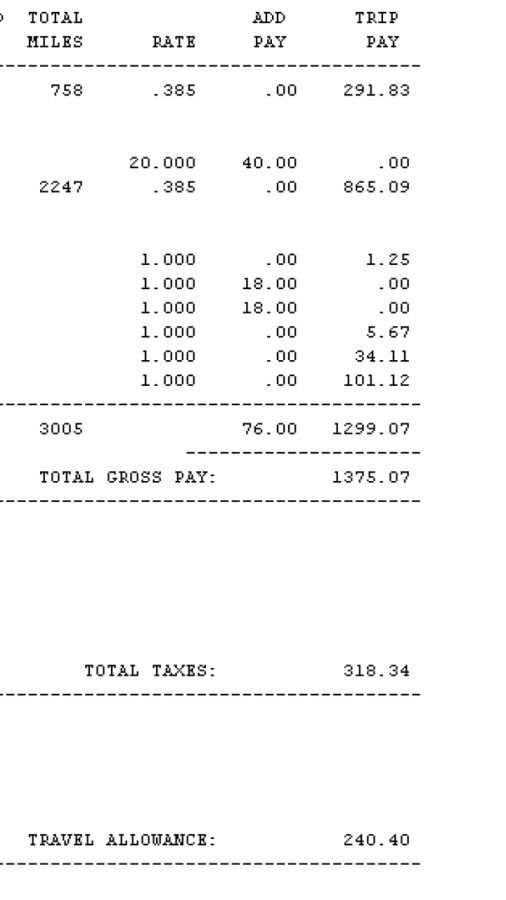

the first column is my miles...total 3005 for the week.

The second column is the "rate" which is the taxable portion and does not include the per diem. the per diem plus the rate equals my cpm.

The "total gross" is the taxable before the per diem. it consists of miles and bonuses.

the tax withheld is applied to this amount.

then the "travel allowance" aka per diem.

so last week i got

Total Taxable Gross $1375.07 (including bonuses)

Tax With held was $318

Per Diem Added $240

$1375.07 + $240 = $1615.07 for the total gross for the week

$1615.07 - $318.34 taxes = $1297

This $1297 is before my insurances and 401k etc.

Thanks Rainy D!

Posted: 6 years, 11 months ago

View Topic:

New per diem laws and affect on lease vs compny

I misspoke on my explanation. Under the new tax bill, companies can still offer a pre-tax travel allowance. That allowance is in addition to the standard deduction offered by the Fed. So if your company pays you 10K in untaxed per diem benefits, and the government gives you a 12K standard deduction, you now have 22k untaxed pay.

https://www.freightwaves.com/news/2018/1/16/ending-the-confusion-over-per-diem

Ahhh. Now that makes more sense. Thanks.

Posted: 6 years, 11 months ago

View Topic:

New per diem laws and affect on lease vs compny

Yes Prime still pays per diem of 8 cpm, and it is a separate line item from your mileage pay. It's also listed separately on your W-2

So just to be clear at Prime if you are paid 42cpm do you get another 8cpm per diem on top for 50cpm total? Or do you get 34cpm and 8cpm per diem for your 42cpm total? Thanks.

Posted: 6 years, 11 months ago

View Topic:

New per diem laws and affect on lease vs compny

Very good article Old School.

I can relate. I have been self employed in the music biz most of my life, and it is all about selling yourself. I have been a performer, concert audio mix engineer, and road manager, with the road manager being the toughest of all. You definitely have to get creative at problem solving, wearing many different hats all while getting no rest to ensure everything goes smooth for the band, promoter and audience. It is also a job you can’t count the hours for your pay. Music is a lifestyle as well. Unfortunately it is not providing enough steady income anymore and the competition for the top paying jobs are insane as there are only a handful throught the country. Not to mention I am tired of playing in bars locally.

I won’t lie this potential adventure into trucking is scary as ***. I have an Uncle who retired from trucking not long ago (who did quite well) and his wife who owns a frieght brokerage, basically said find something else. I’ve always had that kid’s dream of driving a big rig, and I do love adventure and challenge, but the stress takes off years and I don’t have too many remaining (goin on 51 in Feb). However my current situation is about to get very stressful itself (like homeless). This could be a good life reset for me as long as I am able to keep the right attitude and stay on the positive side. I suppose tht is what being grown up is all about, seeing that a bad attitude and negativity means pretty much guaranteed failure. We are all exactly where we are supposed to be in life according to our actions...

Posted: 6 years, 11 months ago

View Topic:

New per diem laws and affect on lease vs compny

Welcome to the forum RobMac, and I'll go ahead and throw an early welcome to Prime.

While waiting for someone more knowledgeable to answer, I'll go ahead and say what I've pieced together on the new per diem laws.

While it's true there is no longer a per diem deduction on your taxes, your standard deduction will be nearly doubled if I remember correctly. So the net result in your income will have no change, or a change slightly in your favor. I'm not the ripest grape in the bunch when it comes to this stuff, but that's how my accountant explained it to me.

Yes Prime still pays per diem of 8 cpm, and it is a separate line item from your mileage pay. It's also listed separately on your W-2

Thanks for the response Turtle.

Posted: 6 years, 11 months ago

View Topic:

New per diem laws and affect on lease vs compny

Hello RobMac, and welcome to our forum!

I never recommend leasing a truck or becoming an owner/operator. I'm a long time business owner who doesn't see any difference in the reward factor of owning or leasing the truck over being a good solid company driver. In fact, I have three friends who were doing well as company drivers who started leasing trucks over a year ago now. They all have confided in me that they made a mistake, but they are holding out in the hope they can turn it around. One of them actually compared notes with me, and he was quite surprised at how much better I was doing than him.

Leasing or owning the truck has unexpected risks that pop up at all the wrong times. Why do you think companies like Prime want to lease their trucks as opposed to just putting good company drivers in them? It's a very simple answer. They cut their risks that way. The driver takes on those unexpected interruptions to his cash flow. The measly tax deduction you'll gain from Per Diem pay will not even come close to covering four or five days of down time with your truck.

Thanks Old School. I honestly don’t want to deal with running a business, particularly as a newbie. I’d rather concentrate on learning what I need to be the best driver/employee I can. Could I make more as a L/O? Maybe, maybe not. The risk and headache just don’t seem to be worth it to me. Im not really up the new tax laws and justbwanted to see what others were thinking. If its only a few thousand difference between itemized or standard deductions, then once again I don’t think the hassle and risk outweigh the reward.

Posted: 6 years, 11 months ago

View Topic:

New per diem laws and affect on lease vs compny

Hello everyone. First off thank you for this website. I have been researching going into trucking for several months and this site has been a valuable tool.

I am very close to applying at Prime (possibly Dec for a Jan orienation). I have read the advice against going lease right out of the gate, and planned to get a year or two as a company driver to learn the ropes. However from what I understand with the new tax laws there is no more per diem deductions for company drivers. Will this be a sitation that could force more drivers to lease? Does Prime pay per diem? If so is it separate from milage pay, or included in the milage? I really don’t want to worry about starting and running a company I know nothing about all while learning a new trade. Thoughts?

Page 1 of 1

TT On Facebook

TT On Facebook

Posted: 6 years, 11 months ago

View Topic:

New per diem laws and affect on lease vs compny

Nice goal to have. Don’t need a taste, I already have the tee shirt. 🙂