New Per Diem Laws And Affect On Lease Vs Compny

Topic 23642 | Page 2

Yes, Yes it does!

We are all slaves to Master Freight. Master Freight is a cruel, relentless master who constantly is cracking his whip. LoL!!!

Or do you get 34cpm and 8cpm per diem for your 42cpm total?

^^ This, only the pay rate is higher than 42cpm now for reefers I think.

The 8cpm is included in the pay rate. It's listed as a travel allowance on your pay stub, and is untaxed.

CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

Reefer:

A refrigerated trailer.

I was under the impression the per diem for company drivers was just a portion of the amount you are already earning, paid as per diem, to give you (and the company) a tax break. Or am I missing something?

Bear in mind, per diem will not show as income for social security purposes, or when you apply for a loan, etc.

Other companies are different, but for us, every day we are not home, sixty-three dollars of that day’s wage is not taxed.

But it isn't extra pay, it is a portion of your normal pay that isn't taxed, correct?

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

But it isn't extra pay, it is a portion of your normal pay that isn't taxed, correct?

That's how it is for us at Prime. The yearly per diem amount we receive by the company will be deducted from the standard deduction allowed by the Fed at the end of the year.

Prior to 2018, the Fed allowed $63 per day as an untaxed travel expense. Any per diem recieved in your weekly check would be deducted from that amount at taxtime. They've done away with the $63 thing this year, and instead have increased the standard deduction. I believe the net result is the same for the employee.

Also, like you said the per diem amount can't be listed as income, although it kinda is. As is usual, this arrangement is probably skewed in favor of the company in the form of lower employer liabilities.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

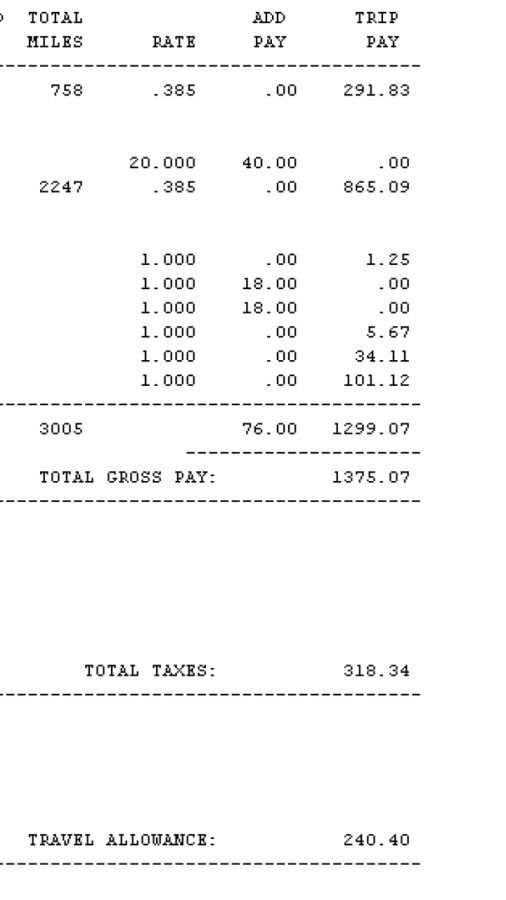

This might help

the first column is my miles...total 3005 for the week.

The second column is the "rate" which is the taxable portion and does not include the per diem. the per diem plus the rate equals my cpm.

The "total gross" is the taxable before the per diem. it consists of miles and bonuses.

the tax withheld is applied to this amount.

then the "travel allowance" aka per diem.

so last week i got

Total Taxable Gross $1375.07 (including bonuses)

Tax With held was $318

Per Diem Added $240

$1375.07 + $240 = $1615.07 for the total gross for the week

$1615.07 - $318.34 taxes = $1297

This $1297 is before my insurances and 401k etc.

CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

Dont get hung up on the cpm and nit pick. i know people who will demand "i drove an extra 15 miles to get repaired or a washout etc, i want my pay". So $7 and you get taxed. you are going to aggravate your dispatcher for $7 when he can load you up with all sorts of freebies? My FM hooks me up when i need it so i dont nit pick.

Today i had a really really bad customer. i sat there for 13 hours yesterday, they lost my bills twice, overcharged for unloading, and they said we shorted them, i went on to my next delivery and lo and behold...the missing cases were never taken from the trailer. so i waited some more until they could figure what to do with it.

Not only do i get paid detention for sitting there, but my FM loaded me up with 2200 miles from Seattle to TX yippee!!! i didnt have to whine and cry to get it.

So i messaged him...

You are my sunshine,

My only sunshine,

You make me happy

with lots of pay,

You ll never know dear

How much i love you

Please dont take

my big miles away!

I brighten his day when he deals.with idiots hahahahba

its not just about not whining or demanding either. i get great treatment cause he knows ill get it done, figure it out, talk to our claims department and he doesnt have to babysit me. im pretty sure he only thinks about me when he sees the screen flash "about to deliver" or he needs me to help out another driver. he has to baby so many people that im not on his list of worry. the only lists im on "when you want another load" and "when you want another student"

lol

greedy guy lol

Dispatcher:

Dispatcher, Fleet Manager, Driver Manager

The primary person a driver communicates with at his/her company. A dispatcher can play many roles, depending on the company's structure. Dispatchers may assign freight, file requests for home time, relay messages between the driver and management, inform customer service of any delays, change appointment times, and report information to the load planners.Fm:

Dispatcher, Fleet Manager, Driver Manager

The primary person a driver communicates with at his/her company. A dispatcher can play many roles, depending on the company's structure. Dispatchers may assign freight, file requests for home time, relay messages between the driver and management, inform customer service of any delays, change appointment times, and report information to the load planners.CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

TWIC:

Transportation Worker Identification Credential

Truck drivers who regularly pick up from or deliver to the shipping ports will often be required to carry a TWIC card.

Your TWIC is a tamper-resistant biometric card which acts as both your identification in secure areas, as well as an indicator of you having passed the necessary security clearance. TWIC cards are valid for five years. The issuance of TWIC cards is overseen by the Transportation Security Administration and the Department of Homeland Security.

The limited reading I have done on per diem has made my head spin ever single time. Was there an annual limit to the $63 per diem, ie a maximum annual dollar amount or number of days one could claim? I am neither an accountant nor lawyer, but If I understand correctly, the new standard deduction would reduce tax liability for the equivalent of about 190 days per year whereas drivers could have claimed $63 for every day they were on the road previously. Drivers are certainly out more than 190 day per year, aren't they? My quick napkin math using Prime home time and vacation numbers would suggest that a drivers (taking 1 day off per 7 out, plus 14 days yearly vacation) would be on the road around 308 days per year.

308 * $63 = $19,404

Compare that to the $12,000 standard deduction now. Doesn't this mean that a number of drivers could be facing a tax bill to make up the difference if they receive over $12,000 "per diem" annually?

Drivers can no longer deduct per diem payouts, but companies can can? I would assume the companies then still do it to reduce their tax burden. Can't say I would blame them. Just trying to understand the extra complication on the pay stub and on tax day.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

I misspoke on my explanation. Under the new tax bill, companies can still offer a pre-tax travel allowance. That allowance is in addition to the standard deduction offered by the Fed. So if your company pays you 10K in untaxed per diem benefits, and the government gives you a 12K standard deduction, you now have 22k untaxed pay.

https://www.freightwaves.com/news/2018/1/16/ending-the-confusion-over-per-diem

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

So i messaged him...

You are my sunshine,

My only sunshine,

You make me happy

with lots of pay,

You ll never know dear

How much i love you

Please dont take

my big miles away!

I brighten his day when he deals.with idiots hahahahba

Somehow, I think sending that to my dispatcher (assuming it is a male) would not be considered funny.

Dispatcher:

Dispatcher, Fleet Manager, Driver Manager

The primary person a driver communicates with at his/her company. A dispatcher can play many roles, depending on the company's structure. Dispatchers may assign freight, file requests for home time, relay messages between the driver and management, inform customer service of any delays, change appointment times, and report information to the load planners.New Reply:

New! Check out our help videos for a better understanding of our forum features

Preview:

This topic has the following tags:

Prime Inc Advice For New Truck Drivers Leasing A Truck Per Diem Pay Truck Drivers Tax Questions

TT On Facebook

TT On Facebook

So just to be clear at Prime if you are paid 42cpm do you get another 8cpm per diem on top for 50cpm total? Or do you get 34cpm and 8cpm per diem for your 42cpm total? Thanks.

CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay