New Per Diem Laws And Affect On Lease Vs Compny

Topic 23642 | Page 3

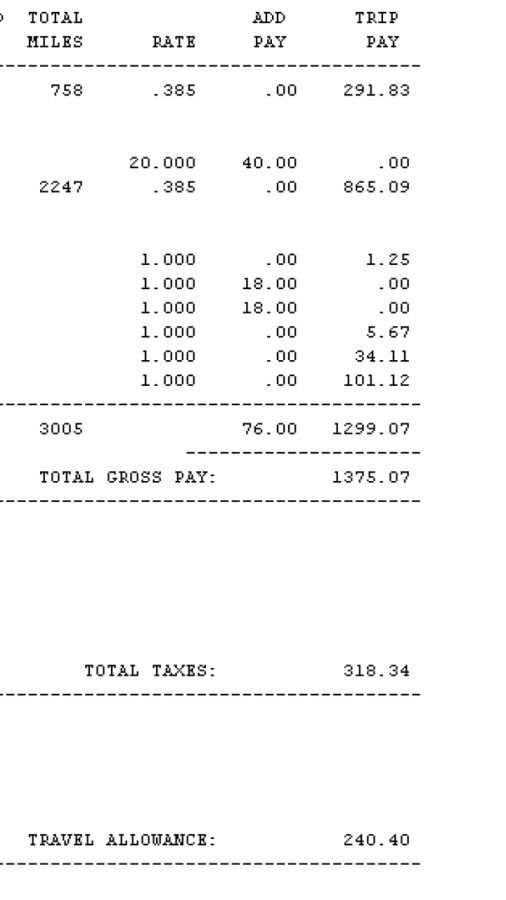

This might help

the first column is my miles...total 3005 for the week.

The second column is the "rate" which is the taxable portion and does not include the per diem. the per diem plus the rate equals my cpm.

The "total gross" is the taxable before the per diem. it consists of miles and bonuses.

the tax withheld is applied to this amount.

then the "travel allowance" aka per diem.

so last week i got

Total Taxable Gross $1375.07 (including bonuses)

Tax With held was $318

Per Diem Added $240

$1375.07 + $240 = $1615.07 for the total gross for the week

$1615.07 - $318.34 taxes = $1297

This $1297 is before my insurances and 401k etc.

Thanks Rainy D!

CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

I have been self employed in the music biz most of my life, and it is all about selling yourself. I have been a performer, concert audio mix engineer, and road manager, with the road manager being the toughest of all.

Welcome RobMac.

Once you get a year or two of clean OTR experience under your belt driving for touring bands/shows/special events is an option. This is what I want to do with my CDL (when I get it and the required experience).

This video clip will give you a taste!

https://youtu.be/dfhH9mx8Eqk

CDL:

Commercial Driver's License (CDL)

A CDL is required to drive any of the following vehicles:

- Any combination of vehicles with a gross combined weight rating (GCWR) of 26,001 or more pounds, providing the gross vehicle weight rating (GVWR) of the vehicle being towed is in excess of 10,000 pounds.

- Any single vehicle with a GVWR of 26,001 or more pounds, or any such vehicle towing another not in excess of 10,000 pounds.

- Any vehicle, regardless of size, designed to transport 16 or more persons, including the driver.

- Any vehicle required by federal regulations to be placarded while transporting hazardous materials.

OTR:

Over The Road

OTR driving normally means you'll be hauling freight to various customers throughout your company's hauling region. It often entails being gone from home for two to three weeks at a time.

I have been self employed in the music biz most of my life, and it is all about selling yourself. I have been a performer, concert audio mix engineer, and road manager, with the road manager being the toughest of all.

Welcome RobMac.

Once you get a year or two of clean OTR experience under your belt driving for touring bands/shows/special events is an option. This is what I want to do with my CDL (when I get it and the required experience).

This video clip will give you a taste!

https://youtu.be/dfhH9mx8Eqk

Nice goal to have. Don’t need a taste, I already have the tee shirt. 🙂

CDL:

Commercial Driver's License (CDL)

A CDL is required to drive any of the following vehicles:

- Any combination of vehicles with a gross combined weight rating (GCWR) of 26,001 or more pounds, providing the gross vehicle weight rating (GVWR) of the vehicle being towed is in excess of 10,000 pounds.

- Any single vehicle with a GVWR of 26,001 or more pounds, or any such vehicle towing another not in excess of 10,000 pounds.

- Any vehicle, regardless of size, designed to transport 16 or more persons, including the driver.

- Any vehicle required by federal regulations to be placarded while transporting hazardous materials.

OTR:

Over The Road

OTR driving normally means you'll be hauling freight to various customers throughout your company's hauling region. It often entails being gone from home for two to three weeks at a time.

As I understand after reading the IRS rules on per diem is that you need to fill out a detail experience report every so often to be tax free else its taxable....unless there are exceptions for trucking which is possible.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

As I understand after reading the IRS rules on per diem is that you need to fill out a detail experience report every so often to be tax free else its taxable....unless there are exceptions for trucking which is possible.

So after re reading the IRS instructions I realized that i had read the old rules which seemed to have had some wiggle room for the expense reporting. The new rules seems a bit confusing at first. 1099 people didn't seem to change too much but the w2 people did. What I can gather is that you can no longer itemize but the per diem stacks on top of the new massive standard deductions increase. Also starting Oct 1 2018 the per diem cap goes up from 63 to 66 per day for transport jobs only.

I will have to wait until the IRS issues the new rules in December to get a better idea since they only have the 2017 rules posted and can really go by other peoples interpretation of the new rules (unless I want to fork out a ton of cash for the books)

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

Eh...youz guyz are analyzing too much. too much effort for me.

in that example i gave above $1600 gross divided by 3000 miles equals 53cpm on which im not taxed on all.of it. and my rate is only 46cpm or something so im well above my pay rate.

i pay an accountant $150 and bam, i get back thousands of dollars.

no matter how you slice it, i now make more than i did as a federal employee and get back twice as much in my tax return. at this point even if i owed taxes which wont happen, id still be ahead of what i made. i even have better health insurance for a lot less money!

so i dont care.

CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

TWIC:

Transportation Worker Identification Credential

Truck drivers who regularly pick up from or deliver to the shipping ports will often be required to carry a TWIC card.

Your TWIC is a tamper-resistant biometric card which acts as both your identification in secure areas, as well as an indicator of you having passed the necessary security clearance. TWIC cards are valid for five years. The issuance of TWIC cards is overseen by the Transportation Security Administration and the Department of Homeland Security.

i pay an accountant $150 and bam, i get back thousands of dollars.

Best advice you will ever get on this or any forum, and there is a ton of good advice here.

Get an accountant, and not just a tax preparer. They will save you money.

so i dont care.

That's fine, but some do care. That's why we're discussing it. The topic of this discussion is understanding the per diem laws.

I pay an accountant too, but I still like to have an inkling of what's going on.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

Definitely hire an accountant. But I find this interesting because I am certified to do taxes and about to finish my accounting degree.

New Reply:

New! Check out our help videos for a better understanding of our forum features

Preview:

This topic has the following tags:

Prime Inc Advice For New Truck Drivers Leasing A Truck Per Diem Pay Truck Drivers Tax Questions

TT On Facebook

TT On Facebook

Ahhh. Now that makes more sense. Thanks.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay