New Per Diem Laws And Affect On Lease Vs Compny

Topic 23642 | Page 4

I too do like Rainy does. In my case, 13 cpm of my pay isn't taxed and paid as perdiem. I email my accountant my W-2 straight from company payroll, he does my taxes, faxes me the signature sheets. I sign them, fax them back, he efiles and voila.. less than 2 weeks later, I have $4-5k extra in my bank account. It's sweet indeed. IDK how he does it, and IDC lol. It's legal and he will represent me in case of any query. I anticipate possibly larger refunds, both federal and state.

Absolutely hire an accountant who's well versed in trucking.

CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

I didnt mean to sound disrespectful. i apologize.

what i should have said is although its good to know, i wouldnt use the per diem formulas to determine a company preference or even decide to enter trucking or not. although turtle and i posted how it works at our company, as others have stated, the formulas vary.

some new drivers go nuts with spreadsheets for months comparing companies, choose a company and for whatever reason they need to leave shortly after. so all that work was for naught.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

OOS:

When a violation by either a driver or company is confirmed, an out-of-service order removes either the driver or the vehicle from the roadway until the violation is corrected.

I really didn't do an in depth analysis. Mine was simple. Rider Policy (check), inverter policy (check), willing to hire me (check), blue trucks (sold)

blue trucks (sold)

I do remember how excited you were about the blue trucks. I have to agree, you've gotta love em!

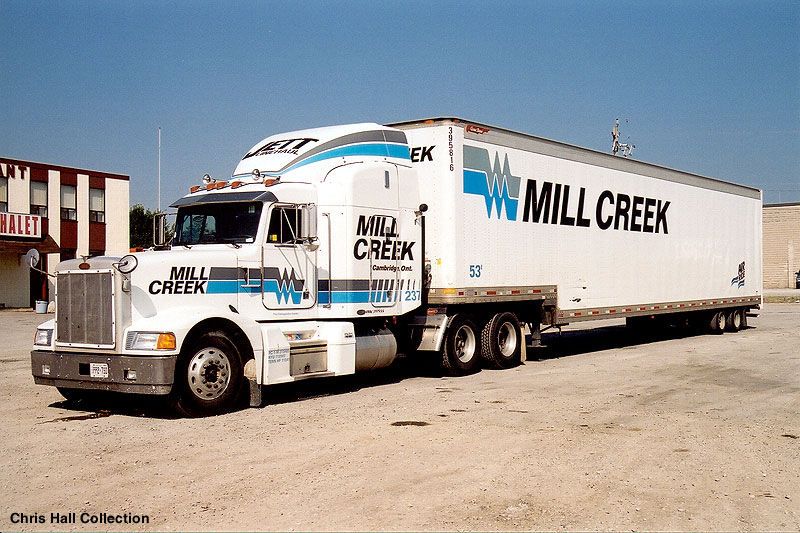

I used to love these trucks from Mill Creek - super cool looking Peterbilts. Man I wanted to drive one so bad!

blue trucks (sold)

I do remember how excited you were about the blue trucks. I have to agree, you've gotta love em!

I used to love these trucks from Mill Creek - super cool looking Peterbilts. Man I wanted to drive one so bad!

You always preach that the name on the door doesn't matter. If that doesn't matter than I am gonna drive the color truck that I want to drive, lol.

I am a simple man to please.

You always preach that the name on the door doesn't matter. If that doesn't matter than I am gonna drive the color truck that I want to drive, lol.

I am a simple man to please.

You gotta admit, that is a sharp looking truck.

Dm:

Dispatcher, Fleet Manager, Driver Manager

The primary person a driver communicates with at his/her company. A dispatcher can play many roles, depending on the company's structure. Dispatchers may assign freight, file requests for home time, relay messages between the driver and management, inform customer service of any delays, change appointment times, and report information to the load planners.

you just made me.spit my soda all 9ver my shiny pretty truck. thanks.

Definitely hire an accountant. But I find this interesting because I am certified to do taxes and about to finish my accounting degree.

Agreed. As both a finance and accounting major, I know I care. I'm always looking for ways to lower (legally...of course) my tax liabilities.

New Reply:

New! Check out our help videos for a better understanding of our forum features

Preview:

This topic has the following tags:

Prime Inc Advice For New Truck Drivers Leasing A Truck Per Diem Pay Truck Drivers Tax Questions

TT On Facebook

TT On Facebook

My company phas a ay stub that is quite ambiguous and I am not sure how I can go from a 1200 gross pay to an 800 paycheck takehome when my fed deductions etc are always less than 200. They pay per diem but at a higher rate (25% of gross) than my pay (21 of something, not sure if it is cpm or % of gross.

CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay