Federal Taxes And Per Diem 2019

Topic 24917 | Page 3

A more understandable explanation for drivers from Freightwave. The link you put up was more for trucking companies than drivers.

https://www.freightwaves.com/news/2018/1/16/ending-the-confusion-over-per-diem

As it stands under the new tax code - per diem (apparently) IS TAX FREE now.

If you are looking to pocket MORE $$ and less taxes, then per diem is actually a GOOD THING, the more the better in fact.

Actually, the changes in tax code make companies that offer per-diem pay, more desirable than companies that don't.

Thanks Mark, for forcing me to poke around some more.

Rick

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

Yet another good, pretty understandable article from Let's Truck:

https://letstruck.com/blogs/kevins-kommentary/understanding-the-new-tax-laws-how-it-affects-owner-operators-drivers

Rick

My company pays 14cpm per diem. And it is optional.

My returns this year improved, but not by a lot.

CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

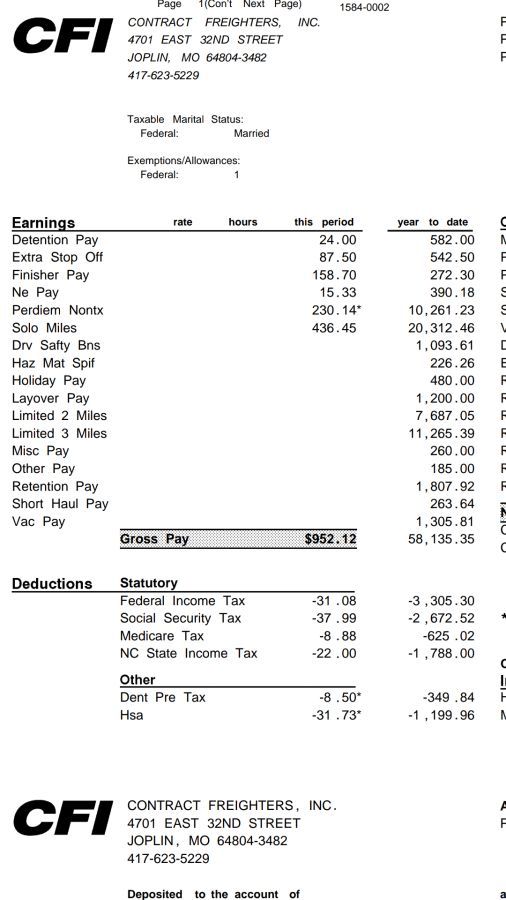

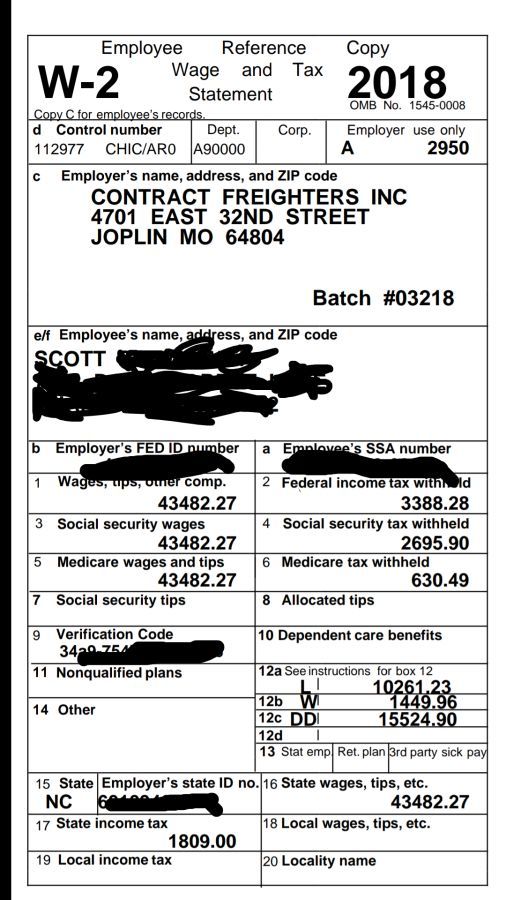

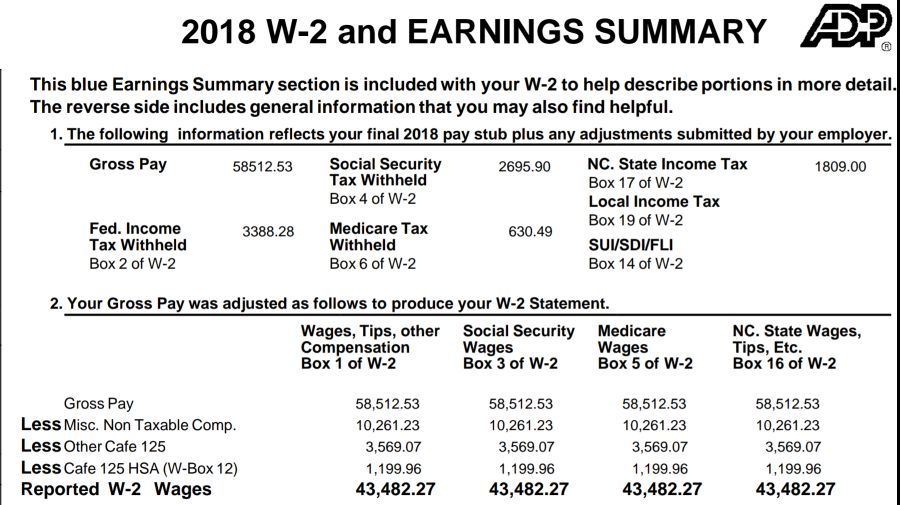

When the new tax laws came about, CFI offered it to us. I have a friend who's wife is a CPA. When she said he would be foolish not to take, I signed on. It has put more money in my pocket each week. To help people see it better here is my final paycheck of 2018, followed by my W2.

Here you can see my gross pay for 2018.

Notice my reported gross taxable income.

I hope this helps some.

I'm going to need to do some calculating but as mentioned earlier each company driver has their own unique financial circumstances. For me I don't have to worry about state income taxes. With the standard deduction doubling to $12K for me, single, I will probably do what I did the last 6-7 years and increase up my 401K contribution substantially to reduce my gross income since this won't impact FICA, Medicare and other benefits in the long run. When companies came up with this per diem scheme I'm sure they consulted with the best tax attorneys and actuaries they could find. Call me cynical but those consultants were working in the companies' best interest, not the drivers.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

HOS:

Hours Of Service

HOS refers to the logbook hours of service regulations.Buckaroo, being a cynic myself, I wondered the same thing. Would these companies be so altruistic that they would have done this only to benefit the drivers? Well maybe because it might help them retain drivers. I don’t know. The same question applies to Lease Operators that the company trys to recruit. Why would the company encourage this unless the company benefited from it?

In this case, the per diem concerning driver benefits, tax wise, is a personal decision outside the companies interests. Take the per diem because overall it financially benefits you personally. How or what the company benefits from it, is their concern. But every once in awhile the planets do align and benefit all parties.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

Yet another good, pretty understandable article from Let's Truck:

https://letstruck.com/blogs/kevins-kommentary/understanding-the-new-tax-laws-how-it-affects-owner-operators-drivers

Rick

Thanks Rick, for the alternative sources. Glad you investigated further to confirm my own findings.

For 2018 I owe $1800 in Federal and $2k in State, and I claimed 2 for each Federal & State all year long, always have. My first year ever living in a state w/ State Income Tax, and hopefully my last.

I look forward to filing next year since I'll have all of 2019 as a Driver (Prior to, I was a corp employee), and getting 7 days/week per diem since the truck is my home, and seeing how this per diem + claiming 2 (single) + no more state income tax (now a resident of South Dakota)

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

New Reply:

New! Check out our help videos for a better understanding of our forum features

Preview:

This topic has the following tags:

Per Diem Pay Truck Driver Salary Truck Drivers Tax Questions

TT On Facebook

TT On Facebook

Hey Mark - thanks for the link.

As I said initially - I haven't done any research on how the changes in tax code affected drivers and per diem.

What the article you linked to illustrates is, with the elimination of itemization, the worksheet for per-diem no longer applies - and per diem pay (for company drivers) is no longer put on the W-2 as miscellaneous income.

What it did mention (which I find weird), is that - if the per diem compensation exceeds the daily rate, it either has to be returned to the company or becomes income.

So I guess per-diem is now a better deal for company drivers, due to the elimination it being included as income and having to do a more complicated return to deduct it.

Sorry if anyone got confused by previous explanations - as I said, I hadn't really done much in depth research on the topic since the tax code changed.

Regards,

Rick

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay