Actual Annual Lease Op Numbers

Topic 25019 | Page 5

It also affects loans, mortgages etc.

One of my friends who grosses $250k per year cannot get a mortgage due to low income, his two kids got almost free college from Pell Grants (for low income) and even collected food stamps.

I do not know enough about the tax side to understand whether or not he set himself up with a low employee wage out of the LLC, or if he just did it as the LLC. But the way I am, I would know everything about it before I took that leap.

But honestly, if i was going through all of that work as an OO or LO, I best darn not be low income. Whether it is a tax trick/ loophole or not.

Army, future SS benefits are a consideration, but really a small one. Unless things have changed and I missed the memo, the SS limit is $2,000 per month no matter how much you made or contributed. The advice I get is that it's much more important to concentrate on your own, non-SS, retirement account. And to do this you need to put away about 15% of your income into an IRA, 401K, or something of that nature. Social Security has never made any recipient a millionaire.(Unless they used their SS payments to buy lottery tickets and actually won). But if you are young and invest in a secure retirement strategy, you will be a millionaire when you retire and then SS will be your petty change. To determine your plan, you need to find a professional investment counselor that you can trust and who has transparency. Do your research and proceed with patience and caution.

Today I'm sitting in the driver's lounge at our terminal in Carlisle, PA listening to two lease operators singing the blues and commiserating with each other about their situation. Both of them are about nine months in and they are both in the negative.

There is no comfort in rationalizing that surely some people make it work. I just don't understand why people will put themselves under such stress with little to no reward for the extra risks involved. Good solid company drivers who understand how to make this career work are earning excellent money. It makes no sense to me to take the risks. Of course, I don't play in the Casinos either. Honestly, there's little difference - the house wins.

Terminal:

A facility where trucking companies operate out of, or their "home base" if you will. A lot of major companies have multiple terminals around the country which usually consist of the main office building, a drop lot for trailers, and sometimes a repair shop and wash facilities.

I have only been on TT for a short time and it amazes me that this topic continues to come up. Basic common sense will tell you that anything that sounds to good to me true, generally is.

DAT current load rates on the high end are $2.65 and on the low end are $1.69. Assuming that a tractor trailer runs 150,000 miles per year, the MOST gross income is $397,500 and the least would be $253,500. Average between these two is $325,500. A lot of money right? Prime pays 72% of the freight bill. That equals $234,000. Assume the cost to run the truck equals $1.00 per mile (assumes no extra ordinary expenses). $234,000 minus $150,000 equals $84,000. So you can make $84,000 per year, or more, IF you have "manage your business" well. That means picking the right loads, efficient driving, managing expenses, and managing risk. In other words, you know the trucking industry. The O/O or lease operators on this forum who prefer that arrangement, manage their risk well. However, anyone who asks the question "should I go O/O or lease," does NOT know the trucking industry. So they have answered their own question by simply asking it.

The question " should I go O/O or lease," is same as Dirty Harry's question (only the older drivers will know this): "Do you feel lucky? Well, do you PUNK."

With regard to tax deductions, if you apply the principles of the tax code, you can understand what is taxed and what is not. Generally, if the money you receive is used to fund or operate your business, its deductible. In other words, if the money you receive is paid to someone else so you can drive your truck, its deductible. Think about that for a minute: are you using that money for yourself. If you are using the money for yourself, its taxable. With this principle in mind, in order to reduce your taxable income to zero (after factoring in standard deductions and certain policy deductions) ALL the money you make would need to be paid to someone else so you can drive your truck. In other words, you use your money for nothing other than driving your truck.

Becaise Old School they dont understand about the rewards until they do it. Whether company or LO

Army, future SS benefits are a consideration, but really a small one. Unless things have changed and I missed the memo, the SS limit is $2,000 per month no matter how much you made or contributed. The advice I get is that it's much more important to concentrate on your own, non-SS, retirement account. And to do this you need to put away about 15% of your income into an IRA, 401K, or something of that nature. Social Security has never made any recipient a millionaire.(Unless they used their SS payments to buy lottery tickets and actually won). But if you are young and invest in a secure retirement strategy, you will be a millionaire when you retire and then SS will be your petty change. To determine your plan, you need to find a professional investment counselor that you can trust and who has transparency. Do your research and proceed with patience and caution.

Bruce

Yes I agree you should not rely on SSI. I was just adding it to the discussion concerning the long term effects of taxable income. And unless the website is wrong, which I doubt, at 62, early retirement age, I can collect 1303.00 at age 67 $1932.00 and at age 70 $2443.00 a month. That is assuming I continue at my currently earning rate. The benefits are pretty significant the more you make the longer you earn money.

Something I was unaware of until recently... i thought lease ops at my company paid into a Workmans Comp insurance. There is a line on their settlement that resembles it. However, they have no injury insurance and no health insurance.

Last week my recent trainee who upgraded in Feb/Mar was talking to a lease op who started with him. The lease op admitted he brought home $850 per week before taxes on average, no insurances. My trainee is bringing home $1100 after taxes and family health insurance, life and disability. he didnt mention vision or dental.

Dm:

Dispatcher, Fleet Manager, Driver Manager

The primary person a driver communicates with at his/her company. A dispatcher can play many roles, depending on the company's structure. Dispatchers may assign freight, file requests for home time, relay messages between the driver and management, inform customer service of any delays, change appointment times, and report information to the load planners.Rainey I can’t imagine why those statements are so lenghty. Mine are generally 3 pages. Revenue, deductions and then each load detailed out. It varies but usually 3 a week. And your very correct I pay for my own benifits. I do get breaks on some things by using the carrier’s discounts. I may have missed it, but I didn’t see truck/cargo insurance listed. Those can very greatly by company.

HOS:

Hours Of Service

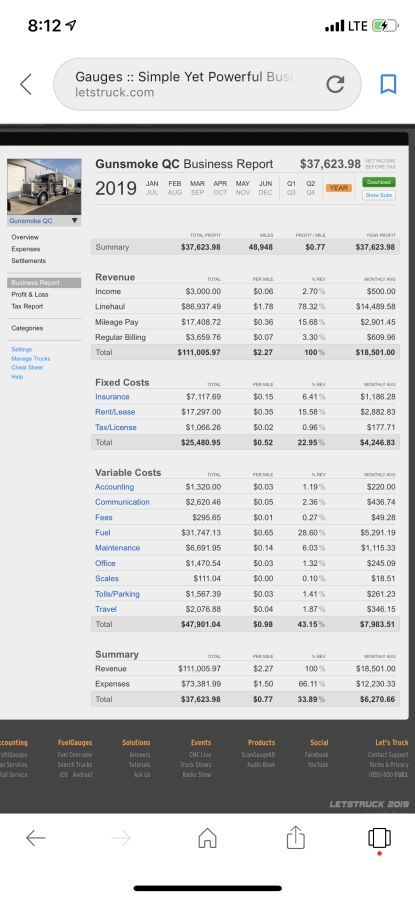

HOS refers to the logbook hours of service regulations.I use very good accounting software. Here is my official business report for the first half of this year. I generally work 3 weeks and take 1 week off. I took a photo so hopefully it is readable. It has all my deductions in it. Bottom line is so far I am making .77 cpm.

CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

New Reply:

New! Check out our help videos for a better understanding of our forum features

Preview:

This topic has the following tags:

Prime Inc Advice For New Truck Drivers Company Sponsored CDL Training Leasing A Truck Owner Operator Truck Driver Salary

TT On Facebook

TT On Facebook

Just another thought and if I am off base, I am sure someone will correct me. BUT, if you scrape together every deduction, to limit your taxable income, that will really lower your benefits for when you are eligible to collect Social Security. I am not implying that one can live on Social Security income alone, but just another thing to consider. Reason I bring this up, is because about 35K of my annual income is not taxable, so when I file my taxes, my annual taxable income is much lower that what I bring in monthly which affects my lifetime earning's when it comes to how much I "should" get when I am eligible to collect.