McElroy Truck Lines

Topic 2878 | Page 26

We must have started about the same time. I hired on At the end on May in 2015. Running out of Ennis TX. They’ve always been good to me and being home every weekend is a big deal for me.

Parrothead, do you do any training out of Cuba?

I run out of Ennis but here lately some of the Texas trainers have been getting guys from the Cuba classes because they’ve had more trainees than trainers available.

Hi everyone, looks like it's been a few months since anyone posted under this McElroy thread. After much deliberation during school, I decided on McElroy and I'm headed to Pleasant Hills NC to start orientation this coming Monday the 27th. Very excited and anxious. Any advice from anyone on the current training/etc at McElroy? Got my CDL yesterday. After 22 years in a corporate office staring at a computer, I took a voluntary early retirement offer at 51 yrs old, to pursue truck driving. I always dreamed of it and always thought I might like it, so I took the chance while the opportunity arose, rather than always regretting not. I can say that I was looking forward to Monday mornings all through school, couldn't wait to get back behind the wheel, I absolutely love driving the big rig. I hope that does not change when it's a "job". Whereas at my office job I was dreading Mondays for years...... Thanks for any advice and updates on their program/etc. I live near Reading PA so I imagine I'll be picking up loads for Lowes at Hagerstown MD alot.

Greg, I am considering McElroy also. I would be doing orientation at the Pleasant Hill terminal. Just wondering what your experience was like and if your still with them? Thanks.

CDL:

Commercial Driver's License (CDL)

A CDL is required to drive any of the following vehicles:

- Any combination of vehicles with a gross combined weight rating (GCWR) of 26,001 or more pounds, providing the gross vehicle weight rating (GVWR) of the vehicle being towed is in excess of 10,000 pounds.

- Any single vehicle with a GVWR of 26,001 or more pounds, or any such vehicle towing another not in excess of 10,000 pounds.

- Any vehicle, regardless of size, designed to transport 16 or more persons, including the driver.

- Any vehicle required by federal regulations to be placarded while transporting hazardous materials.

Terminal:

A facility where trucking companies operate out of, or their "home base" if you will. A lot of major companies have multiple terminals around the country which usually consist of the main office building, a drop lot for trailers, and sometimes a repair shop and wash facilities.

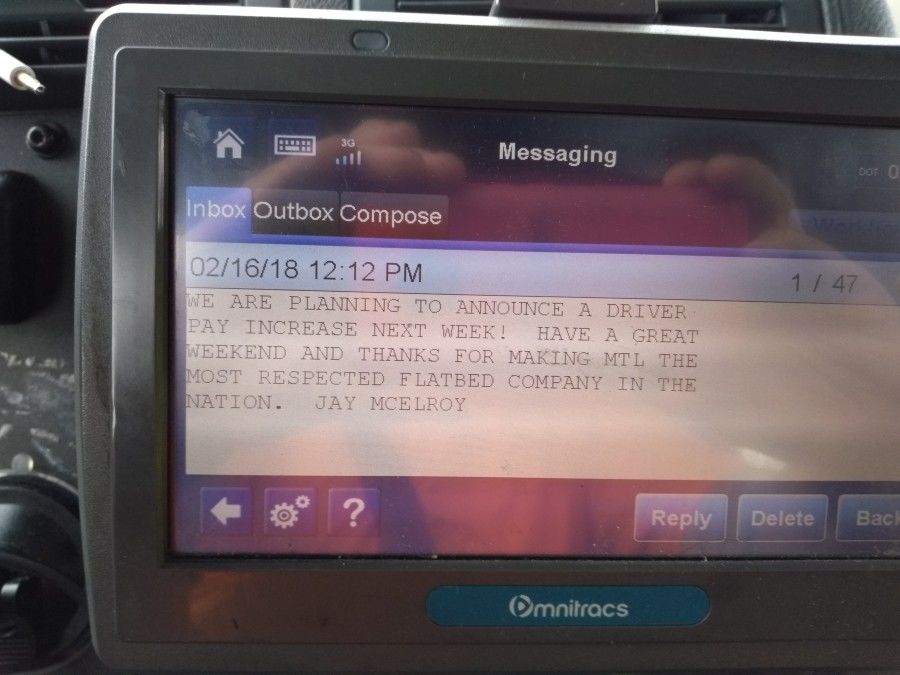

I think McElroy knows the price of drivers is starting to climb.

Man I just started a new post about this before I scrolled down the forums and saw that you posted it here. Hopefully it’s a good one. If Jay needs driver input for the pay plan I more than willing to offer a plan. Haha

A pretty long list of companies have increased their pay packages over the past few months. It's kind of a copycat thing. They all tend to raise or lower their pay packages within a short time frame. It's a little more difficult attracting drivers this time of year. Not too many people up North want to start their career in the dead of winter but freight is pretty strong right now so the wages are going up a bit across the board.

My employer (Pride Transport), initiated several pay increases/changes recently:

1) Mileage breakout by leg of trip and premium rate applied to short distances, resulting in increased pay for each trip since there is almost always a short deadhead portion.

2) Doubling to 20% the company contribution to 401k. They match 20% of what we put in up to the IRS maximum.

3) 2 cpm across the board increase to all pay brackets. This is added to the "per diem" portion of pay if the driver elects per diem. The per diem rate is now 12 cpm, which is deducted from the otherwise applicable rate. If the driver chooses not to accept per diem, then the entire rate is paid taxable.

I am pretty happy with these improvements.

A pretty long list of companies have increased their pay packages over the past few months. It's kind of a copycat thing. They all tend to raise or lower their pay packages within a short time frame. It's a little more difficult attracting drivers this time of year. Not too many people up North want to start their career in the dead of winter but freight is pretty strong right now so the wages are going up a bit across the board.

Deadhead:

To drive with an empty trailer. After delivering your load you will deadhead to a shipper to pick up your next load.

CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

OOS:

When a violation by either a driver or company is confirmed, an out-of-service order removes either the driver or the vehicle from the roadway until the violation is corrected.

2) Doubling to 20% the company contribution to 401k. They match 20% of what we put in up to the IRS maximum.

That is amazing! I hope you are taking full advantage of it. Is that 100% match up to 20% or is it a tiered match?

New Reply:

New! Check out our help videos for a better understanding of our forum features

Preview:

This topic has the following tags:

McElroy Choosing A Trucking Company On The Road In Training Truck Driving Orientation

TT On Facebook

TT On Facebook

Just wanted to say I'm still here with McElroy, almost two years. Still day cab out of Hagerstown MD. I have to say that this company has been good so far. Just had a newborn, the insurance wasn't too bad, and they didn't rush me or the family to come back to work. Only thing I wish was they would pay more, as we are in the show part of the Lowe's season. I have looked on the other side of the fence, but I have to jump jobs for greener pastures when it's just good fertilizer they are feeding you lol.

Day Cab:

A tractor which does not have a sleeper berth attached to it. Normally used for local routes where drivers go home every night.