Changes, Changes, Changes

Topic 32225 | Page 1

We were just told that Heartland is buying us if approved by the SEC. We will still be CFI and still have red trucks. That's all I know for now.

So what about who all YOU guys just bought? Time to go 'article hunting' for me, again!

Links, if any, or screenshots, Scott???

Thanks (I think !)

~ Anne ~

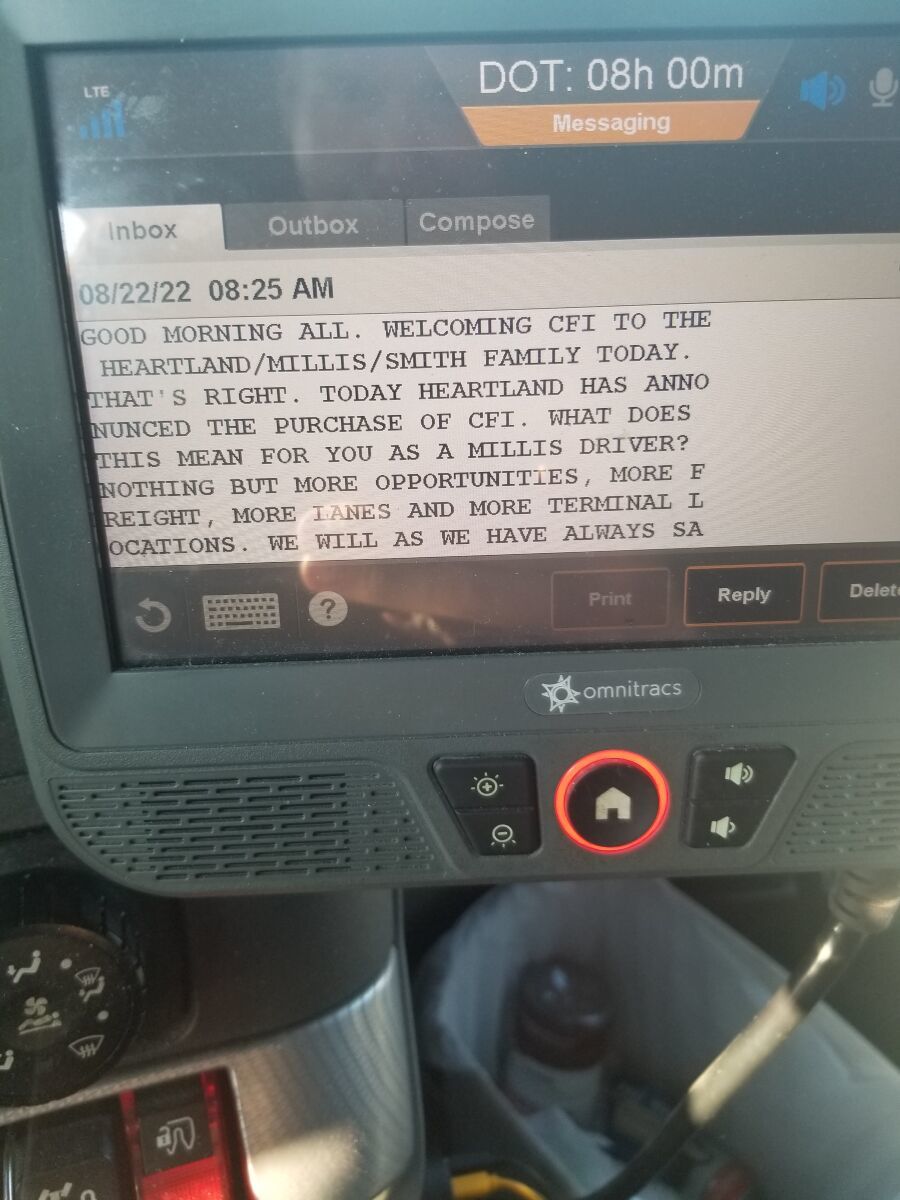

We just got a message on this.

We were just told that Heartland is buying us if approved by the SEC. We will still be CFI and still have red trucks. That's all I know for now.

Interesting. I've always wondered about what motivates one carrier to sell out to another. I believe it's either a mutually beneficial merger or one company trying to keep from going bankrupt. Any other reasons?

Read about it here

We could not have found a better match culturally and financially for this transaction, which will afford CFI the opportunity to flourish and allow us to redeploy capital and focus our U.S. based efforts on LTL , asset-light logistics, and specialized truckload units.

CDL:

Commercial Driver's License (CDL)

A CDL is required to drive any of the following vehicles:

- Any combination of vehicles with a gross combined weight rating (GCWR) of 26,001 or more pounds, providing the gross vehicle weight rating (GVWR) of the vehicle being towed is in excess of 10,000 pounds.

- Any single vehicle with a GVWR of 26,001 or more pounds, or any such vehicle towing another not in excess of 10,000 pounds.

- Any vehicle, regardless of size, designed to transport 16 or more persons, including the driver.

- Any vehicle required by federal regulations to be placarded while transporting hazardous materials.

LTL:

Less Than Truckload

Refers to carriers that make a lot of smaller pickups and deliveries for multiple customers as opposed to hauling one big load of freight for one customer. This type of hauling is normally done by companies with terminals scattered throughout the country where freight is sorted before being moved on to its destination.

LTL carriers include:

- FedEx Freight

- Con-way

- YRC Freight

- UPS

- Old Dominion

- Estes

- Yellow-Roadway

- ABF Freight

- R+L Carrier

Interesting. I've always wondered about what motivates one carrier to sell out to another. I believe it's either a mutually beneficial merger or one company trying to keep from going bankrupt. Any other reasons?

With companies that are publicly traded, a potential motivator is pressure from majority stockholders to increase profits. With fuel prices having cut into profits over the last quarter+, majority shareholders could be lighting some fires. A much preferred solution over filing for some sort of bankruptcy status is to be acquired by another company. The acquiring company can often receive a stock boost from the merger being announced and again as each stage of the acquisition (or merger) is fulfilled. It is a complex calculus of just what the financial and economic impact will be short-term and long-term. Add to this complex calculus that no substantial corporate move of this type happens in isolation, thus resulting in a sort of seismic ripple effect.

OOS:

When a violation by either a driver or company is confirmed, an out-of-service order removes either the driver or the vehicle from the roadway until the violation is corrected.

Wow. Honey Badger(Heartland) dont play. So far its seems to be a good thing for most part. I feel the naysayers have been hushed to an extent. Heard more negative when they acquired Millis than when they acquired Smith. Should we be scared of the "Mega" in this? Hmmm. Time will tell.

Read about it here

We could not have found a better match culturally and financially for this transaction, which will afford CFI the opportunity to flourish and allow us to redeploy capital and focus our U.S. based efforts on LTL , asset-light logistics, and specialized truckload units.

Yeah, 1st place I looked as well, Banks! Seemingly as of late, however (since they won't hire me remotely,) they've been known to post some errors in copy/proof departments. Their 'first' release stated 25 mil . . . LOL!

If y'all have time, the podcast of 56 minutes expounds a bit, yet still leaves some unanswered questions, of course: Heartland/CFI 525 MILLION acquisition!

Banks, any intel on this?!? Quite interesting, yet he should be impervious. Who knows/knew? Long time ago we did the 'contractor' thing. Changes Changes Changes, sure is right! Largest FedEx Ground Contractor...quitting?!?!?

It must be a 'week long' full moon.. or something!

~ Anne ~

CDL:

Commercial Driver's License (CDL)

A CDL is required to drive any of the following vehicles:

- Any combination of vehicles with a gross combined weight rating (GCWR) of 26,001 or more pounds, providing the gross vehicle weight rating (GVWR) of the vehicle being towed is in excess of 10,000 pounds.

- Any single vehicle with a GVWR of 26,001 or more pounds, or any such vehicle towing another not in excess of 10,000 pounds.

- Any vehicle, regardless of size, designed to transport 16 or more persons, including the driver.

- Any vehicle required by federal regulations to be placarded while transporting hazardous materials.

LTL:

Less Than Truckload

Refers to carriers that make a lot of smaller pickups and deliveries for multiple customers as opposed to hauling one big load of freight for one customer. This type of hauling is normally done by companies with terminals scattered throughout the country where freight is sorted before being moved on to its destination.

LTL carriers include:

- FedEx Freight

- Con-way

- YRC Freight

- UPS

- Old Dominion

- Estes

- Yellow-Roadway

- ABF Freight

- R+L Carrier

Looks like Heartland Express is growing.

OWI:

Operating While Intoxicated

Interesting. I've always wondered about what motivates one carrier to sell out to another. I believe it's either a mutually beneficial merger or one company trying to keep from going bankrupt. Any other reasons?

Why does a company sell? It's usually one of three stories:

I like being rich, but don't like trucking - Some truck driver had a dream and built a small to mid-sized trucking company over decades of hard work. He either dies or retires, leaving the multi-million dollar trucking company to his kids and his widow who don't know anything about the industry, but like money so they sell. Gardner Trucking, Reddaway.

They forgot how to run a trucking company profitably - The name says it all, either they lost customers to more nimble competitors, made some bad choices or found themselves on the wrong side of too many jury verdicts. This can either mean the company gets sold as a complete unit or auctioned off piecemeal. Central Freight Lines, New England Motor Freight.

My business plan sucked so I'm taking my ball and going home - Even large, prosperous companies in the freight business have made acquisitions into other regions or other types of freight only to find that their plans didn't work out. Wilson Logistics bought Market Transport in 2019 to expand to the West Coast then sold those assets to Ashley Home Furnishings in 2021. UPS bought Overnite in 2005 then sold UPS Freight to TransForce last year.

Why do trucking companies buy other trucking companies? Because organic growth isn't an option. If a midwest carrier wants to expand to the West Coast they could hire sales people to knock and doors and make phone calls to prospective customers to build relationships, but it's cheaper and quicker just to buy a smaller carrier and get their customers in the deal. It's similar to banks buying other banks - they do it to get new customers because most people won't change banks.

HOS:

Hours Of Service

HOS refers to the logbook hours of service regulations.New Reply:

New! Check out our help videos for a better understanding of our forum features

Preview:

This topic has the following tags:

CFI - Contract Freighters Inc Getting Your CDL The Economy And Politics Trucking News

TT On Facebook

TT On Facebook

We were just told that Heartland is buying us if approved by the SEC. We will still be CFI and still have red trucks. That's all I know for now.