Trucking Employment Is Contracting The Fastest On Record This Century

Topic 33644 | Page 4

From Old School:

[Brokers] have gotten sophisticated with their software and their ability to handle a lot of freight transactions. Tech savvy people have jumped on the bandwagon and tried to garner much of that market share

I haven't looked into the situation with brokerages or why so many have gone under, but off the top of my head, I have two theories that are likely contributors:

1. When interest rates are exceedingly low, people borrow massive amounts of money and invest in risky endeavors. The old Wall Street saying, "There's too much money chasing too few good ideas," comes to mind. Tech startups are high-risk/high-reward propositions that fail far more often than succeed. I expect the surge in brokerages was nothing more than cheap money chasing big opportunities. The tech industry saw the trucking industry as a dinosaur that was ripe for improvement and they took a shot. Unfortunately, when the brokerages struggled and needed more funding, interest rates rose dramatically, and the cheap funding dried up. It became far more risky to continue playing a losing game.

2. Developing technological solutions that create a more efficient system is a far different prospect than understanding how financial markets work and competing within them. Writing software that does something a little better than how it's being done now is pretty straightforward. But using that software to book freight, build a customer base, hedge against risks, and predict the highly-dynamic freight market based on macroeconomic data in an industry you don't know very well is exceedingly difficult.

In "normal" times the trucking industry is mostly a game of survival, fighting extremely thin profit margins and the almost impossible task of separating yourself from the competition. Add to that the complexities of once-in-a-lifetime economic shocks and an environment none of us have ever seen, and you have an almost impossible mission.

Steve Bannon reports that about 8 trillion $ of federal debt (~$37 trillion total now?) is coming up to be refinanced from near zero interest rate to 5% bond rate. Annual interest payments to service the debt will be ~$1 Trillion next fiscal year.

If Yellen can’t sell the bonds the Fed prints more money driving down value of the dollar.

Progressive Leftist Modern Monetary Theory pushes the idea of “unlimited” government debt spending so long as the interest payments can be made.

The proposed fiscal budget is $7 Trillion with a $2 Trillion deficit (they estimated $5 Trillion of tax revenues). However, new outlook from the OMB is for lower tax revenues of ~$4.4 Trillion due to reduced economic activity. So larger deficits keeps growing the total federal debt.

The BRICS countries are banding together to replace the dollar with the Chinese Yuan as the global reference currency, ie Petro Yuan vs Petro Dollar. If that succeeds, things will get a lot worse in US economy. Those countries are supposedly buying up a lot of gold.

This doesn’t even consider a global digital currency system that will subjugate us all to a CCP style Social Credit Score unless the US rejects it.

To top this off the individual tax rate cuts that Trump got passed are set to expire in 2025. The corporate tax rate cuts were made permanent. So we will get screwed again in a couple years.

HOS:

Hours Of Service

HOS refers to the logbook hours of service regulations.OWI:

Operating While Intoxicated

Your prognostication, good sir, could prove to be the most accurate of prognostications to-date this century!

I completely agree with everything Brett laid out. We are in unprecedented times. Things are taking place that we have never experienced before. We just don't know what may happen.

My business background tends to cause me to theorize about business and how it will unfold. I don't recommend any of you take my comments as business advice. I see over capacity as a huge issue right now. Brett laid out a beautiful display of why we are here. He also said this about over capacity...

trucking capacity always lags behind supply and demand. There's always too little capacity in the early stages of increasing demand, and too much capacity in the early stages of decreased demand. Right now we're in the stage where demand is decreasing, but capacity has not reacted enough yet.

I want to preface what I am about to say with the fact that I know I am an eternal optimist. I have to be careful about that personal leaning. It has led me astray before, but I can't help it, that is just how I am wired.

I am anticipating a quicker recovery than many seem to be forecasting. My reasoning is based on what is going on with these large brokerage houses failing so quickly and unexpectedly. Brokers have always had the image of being a parasitic component of the trucking industry. Most people consider them as gouging the rest of us, and making a killing while doing what they do. Now we find they aren't really set up to take the heat that is generated in the kitchen.

They have gotten sophisticated with their software and their ability to handle a lot of freight transactions. Tech savvy people have jumped on the bandwagon and tried to garner much of that market share. Right now we are witnessing some of the large players fold up and crash. These were the folks who were supposed to be making a lot of money. Now the curtain has been pulled back. We find they were operating off of borrowed money and the higher interest rates are killing them. We've had people scoff at us here over the years when we talk about the tight operating ratios in trucking, but we are being proven correct by the current circumstances. It is very easy to quickly get upside down in this business.

This is just my opinion, but I think if we see some more of these large brokerages crash and burn, the attrition rate itself will help us to a quicker recovery. Much of our overcapacity right now is being caused by the brokers. They are in a really tough spot right now. As trucking companies and brokerage houses fall like a house of cards, we should see a reckoning of the problems with over capacity.

Again, I am speculating and I do not recommend anyone take my ramblings as business advice. I have been wrong so many times that you would be foolish to follow anything I say as good prophetic insight.

Quality info, Brett!

April and May of this year were the worst mileage months of my young rucking career. However, for the last 6 weeks, I've averaged +2500 per 5 days worked. This week was short by design, so I can lay it down Sunday through Thursday and get home for Turkey Legs and mashed potatoes!

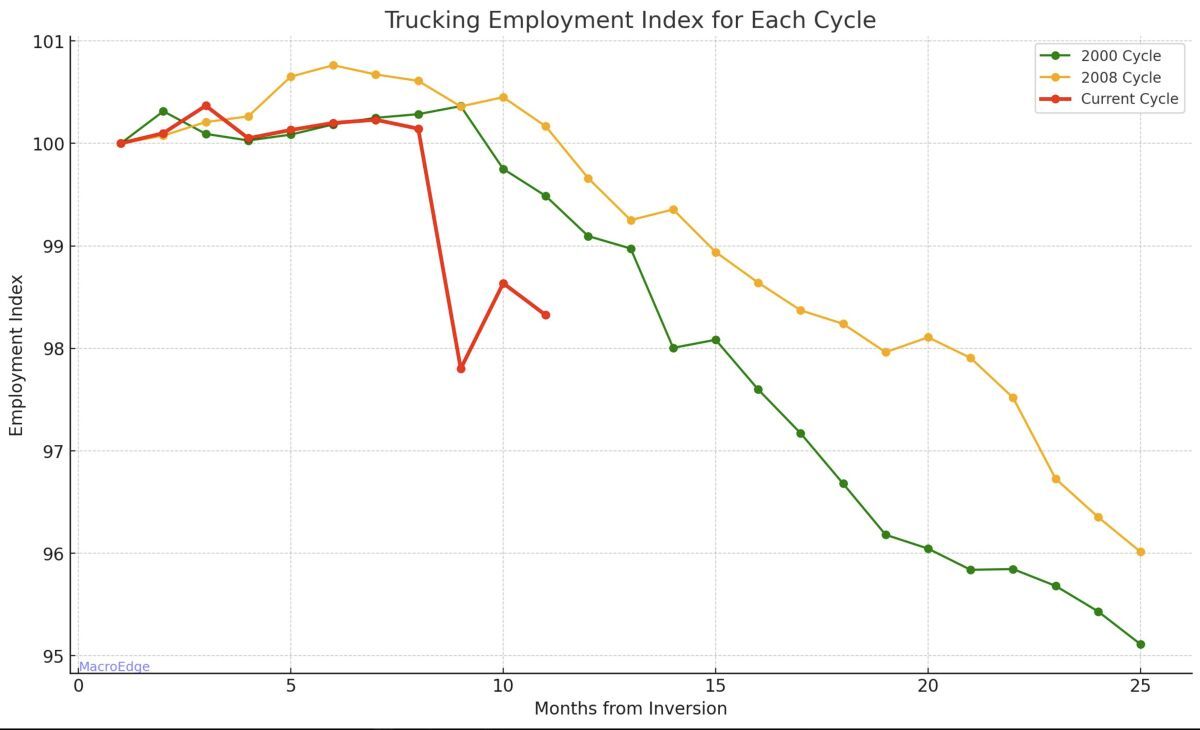

The following chart came from an economist comparing the "employment index" in 2023 (the red line) to the past major downturns we had in 2000 (Tech Stock Collapse) and 2008 (Great Financial Crisis). Apparently hiring is way, way down this year.

Here is the chart:

Obviously, finding work right now in trucking is far more difficult than it was historically, but it all goes in cycles, and things will soon enough return to normal.

I'd love to know how everyone is doing for miles? Are you guys still running hard?

OWI:

Operating While Intoxicated

Interestingly enough, Macy's Target and many larger retailers all posted their highest gains and profits in the history of the companies this quarter and year.

Target cut their costs by a whopping 41 percent, attributed to the lower cost of shipping to the DCs and in fulfillment, shipping from the DCs to the stores.

Macy's said the profits were due to lower freight costs as well and reduced inventory, same with wallyworld.

All three are selling less volumes but at considerably higher margins, that is representing a potential new form in the marketplace. The low cost to move freight can not be understated and is changing the business model.

I find it highly unlikely that the large retailers are not strategizing on how to maintain 40 percent cost reductions and record profits. The overcapacity issues are catastrophic to us, they are a bounty to the retailers and i think they will stop at nothing to keep that going forward.

I utterly agree with all the points Brett laid out, the caviat being that I think the agenda behind it was to eliminate the currency and world order presently in place in order to install a new one that is essentially communal in nature and credits based rather than petro or precious metals backed currency. It obviously didn't succeed but left incredible damage in its wake.

Keeping in mind that "you will own nothing and you will like it" philosophy from the WEF didn't seem to appeal to most of the world.

Hello!

I work for Schneider.

Maybe its just a Schneider thing but the work seems to be up north and not down south. They had me down south for about a month and lets just say there was a lot of sitting. I just got home from 2 weeks out of being up north...non-stop loads and the most miles i have done in single days. 1200-1300 in two days. My back hurts lol.

XPO taking a page from the FedEx playbook and offering voluntary furloughs to drivers. It's going to be a cold winter in the LTL world.

LTL:

Less Than Truckload

Refers to carriers that make a lot of smaller pickups and deliveries for multiple customers as opposed to hauling one big load of freight for one customer. This type of hauling is normally done by companies with terminals scattered throughout the country where freight is sorted before being moved on to its destination.

LTL carriers include:

- FedEx Freight

- Con-way

- YRC Freight

- UPS

- Old Dominion

- Estes

- Yellow-Roadway

- ABF Freight

- R+L Carrier

I get about 1500 miles a week.

I'm not an Economist, but I offer a few observations/questions;

1. If the people making the decisions are protected from the economic realities the rest of us must live with, is it possible the typical economic cycles no longer apply?

2. When the freight was so abundant every company had more loads than they could handle, is it possible many of the companies really weren't very well run and are now struggling? I mean, isn't it possible lousy management was easily hidden by the abundance of loads and revenue coming in?

3. Since so many people have figured out a way to survive financially, without the traditional job is it possible this economic valley will last longer than downturns of the past?

4. On the up-side; with the average age of Drivers being so advanced, is it possible the trucking profession may not suffer long, as many retire out to escape this situation and take their retirement?

5. How long are you (individually, and you don't need to answer it here) prepared to weather the economic difficulties?

As with any economic downturn, I do think there are going to be differences geographically, as well as freight type.

I'm old enough to understand that some general principles are still going to matter. One of the major ones (yes, I know, it's my opinion) is debt management. Whether people like it or not, those with the financial resources to hang in there will be the survivors. Those with heavy debt or low cash reserves, will suffer heavily or shut down.

HOS:

Hours Of Service

HOS refers to the logbook hours of service regulations.New Reply:

New! Check out our help videos for a better understanding of our forum features

Preview:

TT On Facebook

TT On Facebook

All I can say is I hope you’re right Old School. I’m still new at my company but so far I’ve been able to run as many miles as I want/can every week. If I’d been more efficient with my time this week I probably could have gotten another load but I will still finish this week strong with about 3000 miles. I’m not sure how this company seems to be unaffected by everything going on